Date posted: 24th May 2022

We are being asked by many clients whether they need a holding company. The answer is mostly always “it depends”.

Whilst a holding/parent company that is virtually inactive adds additional compliance costs (filing accounts and tax returns), there are numerous benefits which should not be dismissed.

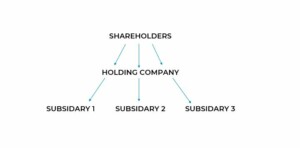

A typical structure may be:

Benefits and requirements may be:

- There may be a valuable asset in your trading company that you wish to protect from a potential downturn in trade – this is usually property but could be plant and machinery, vans etc.

- Once the holding company structure is formed It should be possible to move assets around the group without immediate tax charges.

- You may wish to start up a new venture but doing so inside the current trading company, poses commercial risks.

- You may have multiple trades within one company but wish to sell off one of the trades in the future. It can be easier and cleaner to sell off the shares in a subsidiary company which contains the trade to be sold.

- You may wish to appear larger to the outside world to help you win bigger contracts with bigger organisations.

There are numerous benefits to a holding company structure but taking professional advice is critical, especially to ensure that tax laws are adhered to.

If you are considering a holding company structure and require advice, please give us a call.