Date posted: 25th Nov 2022

The current VAT default surcharge system will be replaced, in January 2023, with a new penalty based points system for all VAT returns that are either submitted late or where the payment is late.

This even includes nil VAT returns and repayment VAT returns.

However, the new system is intended to be more lenient for the occasional “slip up” whilst penalising those that repeatedly fail to comply.

Soft landing system….

HMRC has advised that there will be a “period of familiarisation” and that they will not charge a first late payment penalty (between January and December 2023) as long as the payment of VAT is made within 30 days of the due date.

Submitting the VAT return late – how does it work?

- For every VAT return submitted after the deadline, one penalty point will be received.

- Once a penalty threshold is reached, the business will receive a £200 penalty

- And a further £200 penalty will be issued for each subsequent late submission.

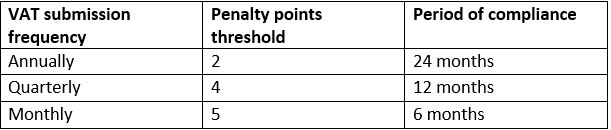

The late submission penalty points system will vary according to your submission frequency.

A business can reset points back to zero by:

- Submitting VAT returns on or before the due date for the period of compliance

- Ensuring all returns due for the last 24 months have been received by HMRC.

Not paying your VAT on time – how does it work?

The penalty depends upon the day that you pay the VAT:

- 0-15 days overdue – there is no penalty as long as the VAT is paid in full or a payment plan is agreed in this period.

- 16-30 days overdue – the business will receive a penalty of 2% of the VAT due on day 15 as long as you pay in full or agree a payment plan on or before days 16-30.

- 31 days or more – the business will receive a first penalty of 2% of the VAT due on day 15 and a further 2% based on the VAT owed at day 30. A second penalty will be calculated at the daily rate of 4% per year for the duration that the balance remains due. This is calculated when the outstanding balance is paid in full or a payment plan is agreed.

As ever, we are here to help clients with their VAT submissions and provide advice when required. Please do not hesitate to contact us with any queries.