Date posted: 31st Aug 2022

What Has Happened and Why?

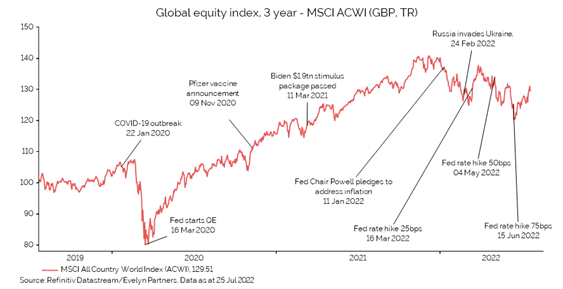

The relatively optimistic start to 2022 was quickly thwarted by geopolitical turmoil in Eastern Europe. The Russian invasion of Ukraine, which started in February, has had a significant impact on markets, which has continued into the third quarter of the year. Inflation has also been increasingly on investors’ minds. It had already been on an upward trajectory this year but accelerated from March. In the UK inflation (CPI) rose from 7% in March to 9.1% by May(1). The oil price rallied from $108 a barrel to a peak of $134 as, on 30th May, EU leaders agreed to ban most Russian oil imports from the region.

In addition, the ongoing effects of Brexit and supply chain bottlenecks created by the lingering COVID crisis in China have exacerbated the situation substantially, contributing to the heightening inflation and seriously impacting the construction and automotive industries amongst others.

The below graphs detail how the main economic and geopolitical events over the past 30 years have impacted the MSCI All Country World Index – it isn’t as bad as you might think.

A closer look:

Having been caught out initially, central banks continued to play catch up during the first quarter, adjusting their views and policies to attempt to bring inflation under control. Things came to a head in June. US markets began selling off heavily as inflation came in higher than expected at 8.6% (CPI) (2), a 40-year high. This, combined with weaker economic data, raised fears the US Federal Reserve (Fed) was behind the curve.

The Fed was quick to respond and announced a 0.75% rise in their base interest rates (3). The Bank of England followed suit but raised interest rates a more modest 0.25% (4) having already started to raise rates at the end of 2021, sooner than the Fed, which began in March. The European Central Bank (ECB) remained the outlier and has not yet started to raise interest rates, although it did indicate they would begin to do so in July, whilst also ending their bond buying programme (Quantitative Easing).

As such, we have seen markets fall across the board, with the S&P 500 down -13.05% year to date and the UK down -13.11% year to date. Bond markets saw their worst opening since the 1700’s in Q2.

Whilst the political turmoil in the UK has been front page news over recent months, the FTSE had largely priced Johnson’s exit in, and we saw relatively little volatility over the period, with supply chains, energy and geopolitical events having a larger impact on valuations.

No Need to Panic

It can be difficult to remain positive on stocks. Nevertheless, we see three reasons to stay the course and remain invested.

First, there are signs that US inflation will peak soon. Unlike inflation of the 1970s, the US dollar has risen in value compared to other currencies. That should lower the cost of imports, keeping prices down. Job vacancies have started to drop which should reduce pressure on wages and therefore inflation. Providing that inflation peaks, central banks will be more inclined to dial back their aggressive tone, particularly if real interest rates turn positive thereby acting as a brake to slow down the economy.

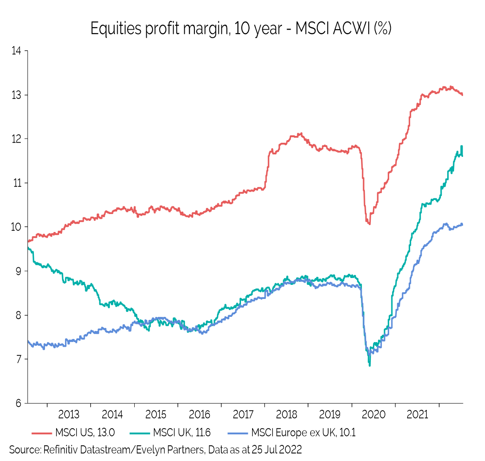

Second, global GDP growth remains relatively robust and company earnings continue to be supported by high profit margins. In contrast to the monetary and fiscal tightening implemented in advanced economies, Chinese policymakers are pumping more money into the economy and cutting interest rates to drive growth. Against this backdrop, company earnings’ forecasts for this year are being revised up.

Third, valuations look reasonable as much of the post-pandemic froth has now gone. Global stocks trade on a Price-to-Earnings ratio of 15 times, which is broadly in line with the long-term average and down from a peak of 20 times which we saw towards the end of 2020. Equities appear in a good position to recover from current levels, assuming inflation will peak soon. Company earnings remain relatively healthy (as we can see from the graph below), and valuations are more attractive. The main risk for investors is whether inflation remains high and leads to a more protracted hangover.

Conclusion

Volatile markets can be very unsettling, but as long as your portfolio is tactically positioned, efficiently managed and comprises of companies with strong fundamentals and long-term growth prospects, there should be little reason to worry. Weathering the storm and being mindful of long-term trends is crucial when investing. As Churchill once said, “If you’re going through hell, keep going!.”

This blog has been written by Angus Wilson of Evelyn Partners.

Email: Angus.Wilson@evelyn.com

For further information: https://www.evelyn.com/

The value of an investment goes down as well as up and investors may get back less than the amount originally invested. Past performance is not a guide to future performance. This article is solely for information purposes and is not intended to be, and should not be construed as investment advice. It is based on our opinions which may change. If you are in doubt as to any course of action you should seek professional advice.

Evelyn Partners Investment Management Services Limited is authorised and regulated by the Financial Conduct Authority.

Data sources are all Refinitiv/Evelyn Partners as at 30 June 2022 unless otherwise stated. Sources:

1 ONS

2 US Bureau of Labour Statistics

3 US Federal Reserve

4 Bank of England