Date posted: 24th Nov 2022

The past 18 months or so have seen a planned increase to corporate tax, then the abolishment of the planned increase to corporate tax and then the abolishment of the abolishment of the planned increase to corporate tax.

So where are we now?

At the moment, there is a flat rate of corporate tax of 19% which applies regardless of the size of the profits of your company. There are additional surcharges for banks, energy companies etc but we are concentrating on owner managed businesses in this article.

What is changing?

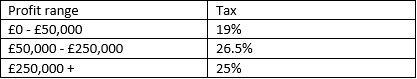

However, from 1 April 2023, there will be a rise in the corporate tax rate, which will be banded as follows:

So a company with £200,000 of profits will pay 19% on the first £50,000 and 26.5% on the next £150,000 = £49,250. This is a blended rate of 24.625%.

Other considerations

However, there are a number of other issues to consider:

- A company will only have the above bands if it is not associated or grouped with other companies. This essentially means it is stand alone and the parties that control the company – shareholders (and their associates) usually but there are many other considerations – do not control another other companies. If a company has associated companies, then the above bands will be shared between them. Care needs to therefore be taken with holding companies.

- If the accounting period is less than 12 months, then the bands are scaled down.

- A companies period of account – there are issues if the accounting period straddles 31 March 2023 in terms of the apportionment of any profit / gains.

- A company may inadvertently be required to pay their tax liability in instalment payments rather than once a year, which may impact cashflow.

Tax planning opportunities

There may be opportunities to save corporate tax and tax this at 19% rather than at the higher rates. There may be options to save tax by:

- Potentially advancing income and / or billing ahead of 31 March 2023, particularly where you have an accounting period that ends before 1 April 2023.

- Delaying expenditure until post 31 March 2023, again particularly where you have an accounting period that ends before 1 April 2023.

- Reviewing bad debts, stocks, pension provisions for directors etc.

- Reviewing the use of any losses.

If you have any queries regarding corporate tax, please give us a call.