Date posted: 26th Mar 2024

It was announced at the 2024 Budget that owners of furnished holiday lets (FHL’s) are likely to pay more taxes going forward.

The rules for owners of FHL’s are to change from April 2025 and those that own such properties need to consider the impact on their circumstances.

To qualify as an FHL, a property must be let on a short-term basis, usually to holidaymakers. The location of the property does not hinder the ability to claim that the property is a FHL as the rules are around the availability of the property to be let, the actual occupation of the property and whether the property is let to one person for a longer-term period.

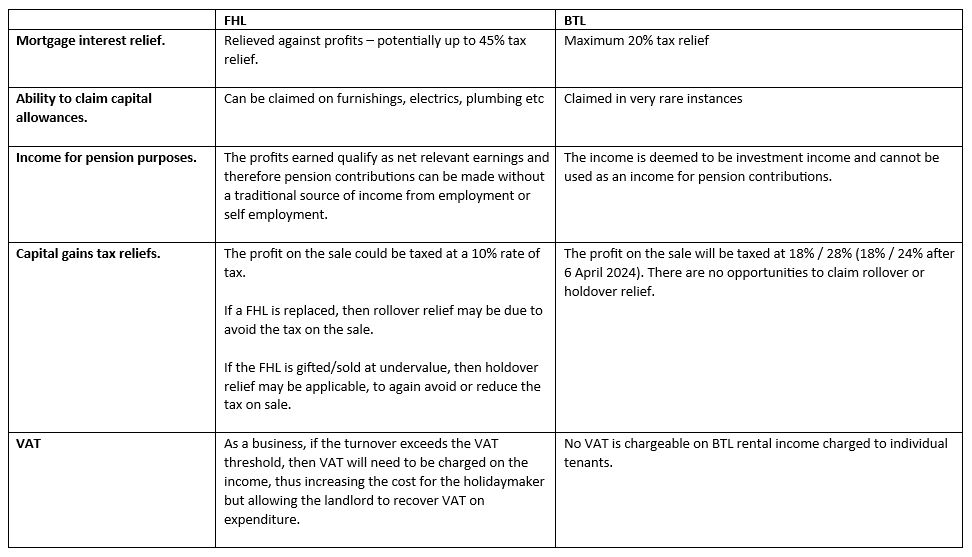

Assuming the rules are met, the tax breaks for FHL can be different to those that own residential BTL properties.

An overview of the differences between the current rules is shown in the table below:

From April 2025 onwards, the FHL tax treatments will align with the BTL tax treatments, apart from the VAT position will remain the same as it currently is.

In the meantime, we await announcements in relation to whether capital allowances previously given will be adjusted and create a tax charge for 2025/26 and similarly in relation to whether there may be a withdrawal of previous rollover or holdover claims. Hopefully not but we await an update from HMG on the rule changes.

Finally, if you are considering selling your FHL, then 2024/25 may be the time to do so, given that you could sell and pay as little as 10% tax on the profit. Delaying could mean a 24% tax charge.

As ever, if you need advice, please give us a call.